Intel’s Message on Higher Education Does Not Compute

Chuck Sheketoff

On the heels of a weekend news report that Intel is taxing Hillsboro and Beaverton schools with the influx of about 400 Israeli children because of an Intel four-month training program for their parents, Intel executives showed up at a business association meeting on Tuesday to complain about the inability of Oregon’s Higher-Education system to produce enough skilled engineers.

Add to that Intel’s refusal to pay its fair share of Oregon’s income taxes and what you get is a message that doesn’t compute.

According to The Oregonian’s Mike Rogoway, on Tuesday Intel VP Renee James bemoaned “that the state’s education system isn’t generating enough skilled workers and that Oregon isn’t doing enough to support entrepreneurship.” She made her comments during the Portland Business Alliance’s (PBA) annual meeting.

Rogoway turned to Intel’s Northwest Region Corporate Affairs Manager Jill Eiland, who also serves on the State Board of Higher Education, the PBA and the Oregon Business Association. Eiland said, “It’s no secret that the state of Oregon has disinvested in Higher-Ed for the last 25 years.”

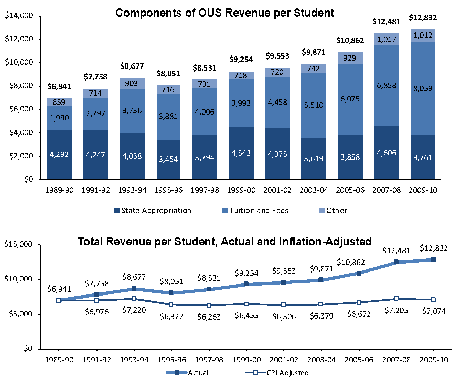

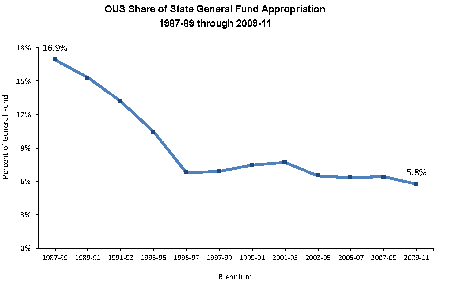

True. This graph from the OUS 2010 Fact Book makes the disinvestment abundantly clear (click image to enlarge):

But according to Rogoway, Eiland just wants Higher-Ed to “run their institutions more like businesses” and “didn’t have a specific prescription for reversing that” disinvestment.

Really? Why can’t Eiland acknowledge that the cure for disinvestment is, well, investment? That should be easy for a member of the Higher-Ed board.

And where should that investment come from?

Not students. What’s kept Higher-Ed barely afloat while the state has disinvested has been increased spending by students. The OUS 2010 Fact Book shows that total revenue per student has stayed fairly flat when you factor in inflation, and that over time students have picked up a larger share of the costs through higher tuition and fees (click image to enlarge):

If not students, then shouldn’t the Legislature be looking to corporations who used to pay significant taxes but now pay just a pittance?

If not students, then shouldn’t the Legislature be looking to corporations who used to pay significant taxes but now pay just a pittance?

In 1997, Intel boasted that it paid $54 million a year in corporate income taxes on $20.8 billion in revenue in 1996.

Since 2003, when Intel last disclosed its corporate income tax payments ($50.9 million a year on average from 1998 to 2001), Intel only boasts about the income taxes its employees pay, not its own corporate income taxes.

By 2010, after another decade of disinvestment in Higher-Ed, Intel probably paid next to nothing in corporate income taxes on its $43.6 billion in revenue. As Rogoway noted, Oregon’s tax system now “exempts Intel . . . from nearly all state corporate income taxes.” Intel’s lobbying the legislature for tax cuts has trumped their complaints about better investments in higher education.

Sadly, Intel’s transformation into a just-a-pittance taxpayer is not unusual. While in the early 1970s the corporate income tax accounted for 18.5 percent of Oregon's income taxes, that share is projected to be only 6.9 percent in 2011-13.

Indeed, Oregon is now projected to get more revenue from state-sponsored gambling than from our corporate income tax. That’s not something the Oregon Legislature ought to be proud of.

It doesn’t take all that much computing capacity to figure out that as corporations like Intel shed their tax responsibilities, it becomes harder for Oregon’s Legislature to invest in Higher-Education. And it becomes harder for the likes of Intel to find the well-educated and -trained workers it needs.

So rather than point fingers and complain about Oregon’s disinvestment in Higher Ed, Intel should direct its lobbyists to ask the legislature to restore taxes on corporate profits so that the state can invest more in its colleges and universities.

But whether or not Intel changes its tune, the Oregon legislature certainly should. Lawmakers should reform the corporate income tax so that it once again brings in meaningful revenue from profitable corporations such as Intel. That would be in the best interest not just of Oregonians, but also Intel and other corporations that benefit from a good Higher Ed system.

Chuck Sheketoff is the executive director of the Oregon Center for Public Policy. You can sign up to receive email notification of OCPP materials at www.ocpp.org.

Chuck Sheketoff is the executive director of the Oregon Center for Public Policy. You can sign up to receive email notification of OCPP materials at www.ocpp.org.

|

More Recent Posts | |

Albert Kaufman |

|

Guest Column |

|

Kari Chisholm |

|

Kari Chisholm |

Final pre-census estimate: Oregon's getting a sixth congressional seat |

Albert Kaufman |

Polluted by Money - How corporate cash corrupted one of the greenest states in America |

Guest Column |

|

Albert Kaufman |

Our Democrat Representatives in Action - What's on your wish list? |

Kari Chisholm |

|

Guest Column |

|

Kari Chisholm |

|

connect with blueoregon

3:17 p.m.

Apr 20, '11

Intel is just more successful at this than most major companies. The constant complaint is that government does not invest enough in education while big corporations do everything they can to avoid paying the taxes necessary for that investment. Intel was silent last year on M66/67 because it wasn't going to cost them much.

Meanwhile Intel pushes for additional tax cuts;"Intel supports a meaningful reduction in the U.S. corporate tax rate. However, we do not support such a reduction paid for by the wholesale elimination of other current tax policies that are intended to provide at least a measure of global competitiveness (e.g., deferral)." http://www.intel.com/Assets/PDF/Policy/Tax.pdf

Of course Intel doesn't pay close to full tax rate. They just announced a 24% tax rate vs. a statutory 35% federal plus state income taxes that generally range from 5-10%.

Intel will always answer that its employees pay the income tax as if employees of other Oregon companies didn't and corporate income taxes did not exist.

7:11 p.m.

Apr 20, '11

No surprise here. It's not enough for corporations like Intel, Columbia, Nike, and Google to get a free ride, they demand additional subsidies and support while retaining the right to freely criticize what is done with the money the rest of us chip in. They are unembarrassed freeloaders.

11:12 p.m.

Apr 20, '11

James’ comments have to be considered in the context of her topic and not the one suggested here. During the decades of the decline in investment in higher education, Intel was engaged in almost continual recruitment of skilled college graduates. The US simply does not produce enough graduates trained in science and math. The very few that take the hard classes and get good grades were given lots of choices and recruitment to Oregon was very difficult.

Intel programs to identify, support and encourage qualified Oregon high school students yielded some great interns but they inevitably left the state. We have a problem and a big part of it is encouraging young men and women to study math and science and to get good grades. Lowering tuition will not help students choose the tougher disciplines.

8:17 a.m.

Apr 21, '11

Steve it isn't that Intel has always recruited nationally, even internationally to get the best employees that is at issue. It is that Intel for years complains about the government's policies while not doing its job as a member of the community to help solve the funding problem of schools. I think that Larry said it best,"they demand additional subsidies and support while retaining the right to freely criticize what is done with the money the rest of us chip in."

9:49 a.m.

Apr 21, '11

But lowering tuition will make it possible for those kids to go to college and keep those kids who do choose math and science (and others) at our state schools. When my son (OSU, engineering) attended in the mid-90's he was able to graduate with minimal debt because of low tuition and adequate state assistance. He went immediately into a high tech job in Oregon and continues to work in Oregon. He's a perfect example of how it SHOULD work in our state and OUS.

My youngest who graduated near the top of her HS class in 2005, went to UO (Honors' College) where the same parental income no longer qualified us for any assistance, was crammed with a roommate into a tiny room in an old dorm, felt anonymous in huge classes, and left after a year for a private college where we had to borrow almost the identical amount as we had to at UO.

At this point in time, It is cutting off your nose to spite your face to not fully support schools from K-university, whether you are an individual or a corporation.

3:17 p.m.

Apr 21, '11

Intel programs to identify, support and encourage qualified Oregon high school students yielded some great interns but they inevitably left the state.

I can't speak to the numbers, but I can speak to my personal experience. From my high school class, there were two Intel honors internship recipients. I was one.

I didn't leave the state, but I did leave engineering. The other guy in my class? He's still at Intel, now nearly twenty years later - and in a fairly senior position.

So, they didn't all inevitably leave the state.

For those that did, here's the problem: 70% of college graduates live within 50 miles of where they went to college. In Oregon, we've disinvested so badly in higher-ed that many of our top students - especially in science and engineering - leave the state for college. And that's where they stay.

If you want to retain the best and brightest, and encourage them to settle here, we've got to have universities that appeal to the best and the brightest.

Portland's lack of a major undergraduate institution that is also a major research university is a serious, serious problem for our economy.

11:18 p.m.

Apr 20, '11

I'm not sure how Intel failed to recognize the impact of bringing 400 children to Oregon for 4 months. I suspect there are a few employees who are now worried about their job! And, it seems totally inconsistent with good practices to relocate so many people for such a short period. I think there is something more to the story and this is most likely a blunder. I suspect it is a red herring for the topic of corporate taxes.

8:11 a.m.

Apr 21, '11

We can agree it was a blunder on so many levels. The whole concept of bringing 100's of families is something that would never have occurred to anyone at Intel 20 years ago. The cost must be incredible. Then treating the community of Hillsboro as an after-thought is just careless.

9:41 a.m.

Apr 21, '11

Steve, I'm not sure "how Intel filed to recognize the impact" either...and maybe they didn't fail to do so but went ahead with their plans anyway. I'll leave it to Intel to explain their logic and disclose their analysis. But the facts are (1)they did bring the families; (2) it is taxing the school systems; and (3) Intel as a corporation contributes less to the state general fund than the $50 million they were contributing each year in the latter half of the 1990s. Red herring? Hardly. If the schools were better funded they could better handle the influx.

1:05 p.m.

Apr 21, '11

My brother used to work for GE. Employees had a "contract" and to get around outsourcing jobs, the company brought in workers from out of country to train them on a project and sent them home to carry it out. That's the first thing I thought of, when I read this. Me thinks, that might be what's behind this. I agree it is germane to corporate taxes. Plus, it is possible these employees might not be paying federal or state income taxes.

1:11 p.m.

Apr 21, '11

Not the case with Intel. The company has had wafer fabs in Israel for decades. Oregon is where the new technologies are developed and then the new technology is transfered to the other plants around the world. In the past they brought over fewer people and then sent Oregon technical types overseas to train the plants. This is more massive than I have heard before, but the mission isn't.

2:48 p.m.

Apr 21, '11

Of course it computes:

Privatize profits and socialize costs - it's the corporate way.