The Four Flaws of a Capital Gains Income Tax Cut

Chuck Sheketoff

It’s unfortunate that some Oregon lawmakers are pushing to cut the tax rate on income from capital gains. Several legislative proposals exist (and no bill is truly dead until adjournment sine die) to grant preferential treatment to income generated from the sale of assets such as stocks, bonds and real estate. This misguided policy fails on four fundamental levels: it favors some taxpayers over others, it’s ineffective, it’s unnecessary and it’s irresponsible.

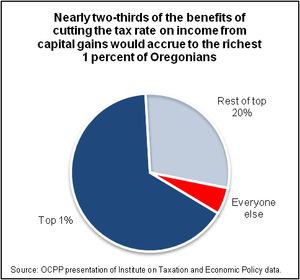

Cutting the income tax on capital gains favors speculators over workers and favors the rich over the rest. It would create a situation where ordinary Oregonians working for paychecks would end up paying a higher tax rate on their income than someone who lives off of investment income. It would also, by and large, constitute a tax cut just for the rich. If Oregon halved the income tax rate on capital gains, the richest 1 percent of Oregonians would get 65 percent of the tax cut. The rest of Oregonians would receive little or nothing.

Cutting the income tax on capital gains favors speculators over workers and favors the rich over the rest. It would create a situation where ordinary Oregonians working for paychecks would end up paying a higher tax rate on their income than someone who lives off of investment income. It would also, by and large, constitute a tax cut just for the rich. If Oregon halved the income tax rate on capital gains, the richest 1 percent of Oregonians would get 65 percent of the tax cut. The rest of Oregonians would receive little or nothing.

Cutting the income tax on capital gains is also ineffective as a means to attract investment, contrary to what proponents claim. Demand for products and services, not the amount of after tax income, is what drives investment. Thus, a general tax cut on income from capital gains will have no real impact on investment. Plus, there’s no guarantee that the money would be reinvested in Oregon. And for those who argue for a targeted tax cut for money reinvested in the state, Oregon’s own experience demonstrates the futility of such an effort.

Cutting the income tax on capital gains is also unnecessary, since Oregon’s economy already tends to outperform the nation as a whole. In recent years, Oregon’s economy has grown faster than that of the nation and has attracted more than its share of venture capital, even though, like a majority of states with income taxes, it taxes income from capital gains the same as any other income. Indeed, more taxpayers with capital gains income move to Oregon than move out, and collectively, in the year of their moves, those arriving have more capital gains than those who leave Oregon.

Finally, cutting the income tax on capital gains is irresponsible. During difficult economic times, income from capital gains constitutes an important source of revenue to fund popular and vital public services. During good economic times the income tax on capital gains shines, often generating more revenue than anticipated. If this unanticipated revenue were saved in the Rainy Day Fund, Oregon would be better-positioned to weather bad economic times. By giving preferential tax treatment to income from capital gains, the income tax would not shine so brightly in good years, harming Oregon’s ability both to fund vital and popular public services and to save for rainy days.

Read The Four Flaws of a Capital Gains Income Tax Cut (PDF) and discuss.

Chuck Sheketoff is the executive director of the Oregon Center for Public Policy. You can sign up to receive email notification of OCPP materials at www.ocpp.org.

Chuck Sheketoff is the executive director of the Oregon Center for Public Policy. You can sign up to receive email notification of OCPP materials at www.ocpp.org.

|

More Recent Posts | |

Albert Kaufman |

|

Guest Column |

|

Kari Chisholm |

|

Kari Chisholm |

Final pre-census estimate: Oregon's getting a sixth congressional seat |

Albert Kaufman |

Polluted by Money - How corporate cash corrupted one of the greenest states in America |

Guest Column |

|

Albert Kaufman |

Our Democrat Representatives in Action - What's on your wish list? |

Kari Chisholm |

|

Guest Column |

|

Kari Chisholm |

|

connect with blueoregon

2:58 p.m.

Jun 15, '11

In all seriousness, Chuck, I wonder what your thoughts are about incentives to business in general. Most of your posts seem to reject most policies related to tax cuts, tax incentives, or other tools often used in economic development practices.

I'm curious to know what you believe is a better alternative in creating jobs, recruiting new companies to diversify the economy, and assisting local businesses with expansion.

Thanks!

10:34 p.m.

Jun 15, '11

Oh, so it does work.

Chuck, One other consequence of such tax cuts is that there is no incentive to put money to work in wages or direct investments in physical plants. A real business is work, screwing around with stocks and other speculation is a lot less work and much better treated by tax rates.

4:00 p.m.

Jun 16, '11

The capital gains debate aside, Chuck, how can you write with a straight face "Oregon’s economy already tends to outperform the nation as a whole"?

Oregon, which fell deeper into the recession than the country as a whole, has come back somewhat stronger in the last couple of years. Still, our average income been dropping behind the rest of the country for the last thirty years, and specifically the last ten. For the great majority of those years, we've also had higher unemployment.

I think this has more to do with structural changes in the state economy than our tax and spending policies but it hurts your case to pretend that our economy leading the rest of the nation and that our only problem is that the rich just aren't paying enough taxes.

1:25 p.m.

Jun 17, '11

I can't speak for Chuck, but I think living and running a business in a beautiful, diverse state, having a healthy, safe, happy & well educated workforce and becoming an asset to a community would be great incentives for companies to locate in Oregon. Do companies locate anywhere because its a dangerous craphole with ignorant, desperate, sick, miserable workers who can't wait to get away from there? Oh wait, that's called outsourcing, the realm of true Patriot Capitalists.