Oregon’s Mushrooming Millionaires

Chuck Sheketoff

Oregon’s millionaires are expected to mushroom this decade, which makes one wonder why some lawmakers feel compelled to shower them with tax subsidies in the form of lower tax rates on their investment income.

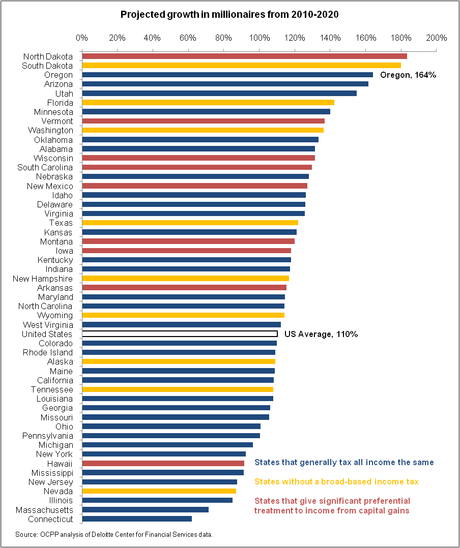

Millionaire households in Oregon will almost triple in number by 2020, according to a new study by Deloitte LLP’s global financial consulting group, the Center for Financial Services. Deloitte projects that Oregon will have the third highest growth in millionaire households from 2010 through 2020 among all the states. Deloitte published its study (PDF) to help “wealth managers” plan their marketing to the rich.

Deloitte estimates that in 2020 about 20.6 million American millionaires will hold $87 trillion in wealth ($4.2 million on average), up from the 10.5 million American millionaires who hold $39 trillion in wealth ($3.7 million on average) in 2011. The Deloitte wealth totals include financial assets such as stocks, bonds, and other investments, and nonfinancial assets such primary residences and consumer durables.

Oregon is expected to have the third largest growth in millionaire households from 2010 to 2020. Deloitte estimates that Oregon will see the number of millionaire households climb from 112,000 in 2010 to 296,000 in 2020, a 164 percent increase.

Among all the states and the District of Columbia, Oregon will rank 24th in the number of millionaire households in 2020, up from 25th in 2010.

Only North Dakota and South Dakota will see a greater growth rate in millionaire households than Oregon, but they will still have relatively very few millionaire households. South Dakota will hold steady at 49th in the rank of numbers of millionaire households in both 2010 and 2020, while North Dakota will climb from 51st in 2010 to 50th in 2020 in numbers of millionaire households.

According to Deloitte, Oregon’s millionaire growth rate will outpace all but one state (South Dakota) with no broad-based income tax. Oregon growth rate is expected to be 21 percent greater than Washington’s (ranked 9th) and 89 percent greater than Nevada’s (ranked 47th), for example. And Oregon’s growth rate will exceed that of all but one state (North Dakota) that give significant preferential treatment to wealthy speculators with lower tax rates on income from capital gains. Oregon’s growth rate is expected to be 25 percent greater than Wisconsin’s (ranked 12th) and 29 percent greater than New Mexico’s (ranked 15th), for example.

In short, the study projects that Oregon’s well-to-do households will continue to do well, thank you very much, under our current tax system.

For Oregon lawmakers, the report’s lesson is different than that for the “wealth managers” who are Deloitte’s primary audience. Oregon lawmakers are supposed to be the people’s representatives, who look to further the common good. They are the managers of the public structures — education, health care and public safety — that nurture the middle class and protect the vulnerable.

Yet right now, a number of lawmakers — Republicans and Democrats — and the Governor propose cutting the income tax on capital gains. That would hand a huge tax subsidy to millionaire households.

Like I said, with millionaire households mushrooming in Oregon, it makes one wonder why . . .

Chuck Sheketoff is the executive director of the Oregon Center for Public Policy. You can sign up to receive email notification of OCPP materials at www.ocpp.org.

Chuck Sheketoff is the executive director of the Oregon Center for Public Policy. You can sign up to receive email notification of OCPP materials at www.ocpp.org.

|

More Recent Posts | |

Albert Kaufman |

|

Guest Column |

|

Kari Chisholm |

|

Kari Chisholm |

Final pre-census estimate: Oregon's getting a sixth congressional seat |

Albert Kaufman |

Polluted by Money - How corporate cash corrupted one of the greenest states in America |

Guest Column |

|

Albert Kaufman |

Our Democrat Representatives in Action - What's on your wish list? |

Kari Chisholm |

|

Guest Column |

|

Kari Chisholm |

|

connect with blueoregon

2:19 p.m.

Jun 2, '11

"Oregon’s millionaires are expected to mushroom this decade, which makes one wonder why some lawmakers feel compelled to shower them with tax subsidies...."

Examination of campaign contribution reports should quickly end the wondering.

Good work, as usual, Chuck.

2:21 p.m.

Jun 2, '11

Chuck, I agree with you on your main point – let’s not cut the capital gains tax.

But, two points:

(1) Being a millionaire is not what it used to be. Deloitte, if I understand their reports, is using net assets, including residences, and not annual income to determine millionaires. Lots of “millionaires” would be what we would consider middle class – such as teachers and public service workers – whose combined values of their homes and retirement accounts could often exceed one million dollars.

(2) I find it interesting that “Singapore may rank No. 1 in 2015 and 2020 with $4.5 million and $5.4 million, respectively, in per capita wealth.”

6:22 p.m.

Jun 2, '11

I believe "millionaire" is usually taken to refer to net worth, not annual income. Oregon median household net worth is $137,980, so millionaires are doing quite well, whatever their sources of income.

11:34 p.m.

Jun 2, '11

Correct - "Millionaire" is a reference to assets, not annual income.

2:29 p.m.

Jun 3, '11

$137,980 is a 2007 number, but given the recent decrease in real estate values, it may be less today.

6:28 p.m.

Jun 2, '11

Why should wages paid to the people who do the actual work be taxed at a higher rate than the profit of investors?

9:39 a.m.

Jun 3, '11

The question is, why should people who work for their money be taxed more than people whose money works for them?

Answer: Its the golden rule. Those with the gold make the rules.

11:08 a.m.

Jun 3, '11

I invest part of my money in Oregon in start ups here.

The money that I invest that way I could lose. The state won't compensate me for that loss. I do it because I want to build jobs in Oregon and make a profit while doing it.

But the math of whether I should risk all that money is significantly affected by what happens if the business I invest in takes off. If a significant chunk of the upside goes to the state, but all the downside risk goes to me, I have little incentive to invest.

While I know it isn't popular with my fellow democrats, lower capital gains encourages me to invest my money in ways that grow the state. Higher capital gains discourages me.

And yes, I pay the same taxes as everyone else on my wages. The question is how does the state want to incent me to behave with my saved capital? Invest it, or hold it?

3:58 p.m.

Jun 3, '11

"I invest part of my money in Oregon in start ups here. The money that I invest that way I could lose".

This is a silly. You offer a theoretical proposition: that money paid in capital gains tax could reduce money in private investment that would lead to economic growth. That makes sense, but investment and growth are things we can measure and analyze, and we do measure and analyze them. So we know that the effect you warn against is not such a big problem, and that weakness of public infrastructure is a actually a bigger problem for a healthy economy.

If you would spend more of your valuable time tending your investments, and less trying to drown Oregon's government in a bathtub, both you and Oregon would do better.

1:22 p.m.

Jun 4, '11

There is nothing theoretical about it. I am actually investing that money in Oregon start ups. Change the capital gains rate and I will change the way I invest.

1:25 p.m.

Jun 4, '11

And the shot about "drowning oregon's government in a bathtub" is tacky and stupid. And indicative of the stupid class warfare that some of my fellow democrats insist on engaging in.

Why don't you just call me a nazi and get it over with?

12:47 p.m.

Jun 7, '11

The behavior of one person would be a very poor guide for inspiring government policy. Do yo see yourself as THAT important?

12:57 a.m.

Jun 10, '11

It's not the job of the state to incent your investing. That's the job of the businesses who want your investment.

11:04 p.m.

Jun 2, '11

ROTFL - I'd like to meet a teacher who has assets of a million dollars.

1:33 a.m.

Jun 5, '11

If being a millionaire is not what it once was, then please sign me up.

...heck, I'd settle for being a 500,000-are.

...honestly, I'd be ecstatic to have 10k in assets.

3:54 p.m.

Jun 2, '11

Now that we have these figures, let's scheme on how to take money from these hard working yet "greedy" people!

After all no one should be allowed make money in this state without asking the state for permission and without being robbed for the "common good".

6:24 p.m.

Jun 2, '11

Oooh, such clever sarcasm! Have you sent your resume to FoxNews?

11:41 a.m.

Jun 3, '11

It had to make you chuckle a bit! Ha! :)

6:30 p.m.

Jun 2, '11

How is someone who has money to invest "hard-working"...?

And do tell how anyone makes money without the public institutions and infrastructure that allow a modern society and economy to function?

Thanks in advance.

9:00 p.m.

Jun 2, '11

Someone who has money to invest likely worked their tail off to get that money. They are probably innovators, entrepreneurs, wise with their money, well educated, or some combination of these. Likely they planned their lives carefully, foregoing a family until later in life, and probably worked 12+ hour days 7 days a week for a number of years.

How do you presume one acquires wealth? Unless they won the money through gambling, or had a large inheritance I would say they are probably hard-working. I don't know any lazy, lay-around wealthy people.

On another note, why is it presumed to be 'bad' (judging from the tone of the article and comments) that there are a growing number of millionaires? I just don't get the resentment - there are ALWAYS going to be people who make more money that you, no matter what laws or taxes are put into place. If you want to earn/acquire more money, get educated, invent something, start a business, don't have kids you can't afford, don't get involved in crime/drugs, start saving and spend what you have wisely, it's really not rocket science.

11:36 p.m.

Jun 2, '11

Some people who have assets to invest are hard-working. Others are not.

Will you join us in supporting a strong estate tax - to ensure that America remains a land of opportunity, not a land of aristocracy?

3:21 p.m.

Jun 3, '11

Yes! Instead of robbing the living, let's rob the dead!

What a great scheme! After all it will be easier than taxing those living "greedy" millionaires who still have life in them to fight back against state sanctioned theft.

8:24 a.m.

Jun 3, '11

Why do some folks always see resentment in the concept of progressive taxation? It is not about resentment. Figure it out. Stop behaving like a dolt.

10:04 a.m.

Jun 3, '11

Here is a real life example of the arbitrariness of the capital gains taxes.

Houseflipper buys home in foreclosure for $100,000. Puts two months and $15,000 into it. It's now worth $200,000, and good for her. her expected profit, after costs of acquisition, repair and sale, is about $70,000. Her mortgage payment, utilities and taxes are $950/mo.

She has two choices at this point.

She can sell it, and assuming she is in the 28% tax bracket, pay taxes of $19,600.

Or she can rent it for ten months at $950/mo, breaking even on the cash flow, then sell it, saving 13% in taxes, for an additional profit of $9,100.

There is some risk in holding onto the property for another 10 months. Though there is some possible gain as well. But whatever risk there is from holding onto the property isn't producing any economic benefit to the economy. She's not investing in new plant and equipment meant to produce jobs. She's simply trying to get a lower tax rate. So there's no policy reason to grant some tax benefit in this case.

The appropriateness of cap gains tax rates is much more complicated than awarding tax breaks to people who take risks. How is someone who invests in Starbucks for 15 months instead of 10 months taking some risk that should be rewarded?

And the reason it doesn't make sense but we have the arbitrary laws anyway??? See my above post. The golden rule. Investors desire to pay less taxes. Calling it long term capital gains and arguing that it is at risk is the way to justify the lower tax.

Now, if you want to encourage real (not fake) risk taking, then what we can do is protect investors on the downside. Not reward them on the upside. In either event it protects and encourages risk taking. And that is important.

So, we could for example, adjust the tax basis for investment by the rate of inflation. Easier said than done, I imagine. But I' sure some certifiably smart people can devise some rules for it and also minimize the gaming that goes on.

7:15 p.m.

Jun 2, '11

6:23 p.m.

Jun 2, '11

WTF? I thought that people with money were going to leave the state in droves now that measures 66 and 67 are on the books.

Memo to Todd: Oregon has the 5th lowest state and local taxes in the nation. If you really gave a rip about economic development, you would be pushing for greater investment in infrastructure and higher education as these are the engines of long-term economic growth. Of course, as we all know, what you care about -- from 9-5 anyway -- is ensuring that multi-state and multi-national corporations can internalize profits, externalize costs, and that we have a tax system that is designed to help the wealthy few at the expense of everyone else.

Truly, yours is a noble calling.

1:30 a.m.

Jun 3, '11

Really a million dollars isn't that much money anymore. In one post I saw someone question if any teachers were worth $1 million plus. Not that they earned it teaching, but I know public school teachers worth over $1 million- a lot of people have huge paper evaluations on real estate. I know an 80 year-old woman who lives in a 2 bedroom house in John's Landing her family has owned for 70 years. Since it's yupification by real estate developers her value is over $300,000. In 1960's that house would have been worth less than $10K and it is extremely modest. I'm not that big on taxing capital gains on individuals until corporations are taxed even at 1960 levels. Where can the common person invest today with any hope of even a modest return? For the average joe it's the stock market even though we all know it game is rigged. Look at CD rates, savings accounts, etc. If you are looking to Democrats to help poor people you're about 70 years late on that one.

9:18 a.m.

Jun 3, '11

Having more millionaires could be a boon to Oregon, or could be a problem.

As Kari noted, millionaire usually refers to assets. These assets could be:

real property; could be a home, a building, land, or a combination. Unfortunately these are likely to be illiquid assets, so there must be an income stream to pay property taxes. Also, some property may have tax exemptions.

tax free municipal bonds; the interest income will not generate any tax revenue for Oregon, but the bonds do help Oregon projects.

other investments like stocks, bonds, partnerships, etc. The assets will not generate any tax revenue unless they are bought and sold, generating capital gains; or pay dividends, which might result in income tax revenue (not all dividends are taxable). Also, only long term capital gains get preferential tax treatment. People who trade regularly will have to treat their gains as ordinary income, taxed at the same rates as earned income.

actual earned income from a job: salary, bonuses, etc. This will also generate tax revenue, unless the income is placed into a retirement account or some other deferred account.

Focusing only on capital gains benefit adjustments looks at only part of the tax revenue issue.

The challenge will be recognizing the complexity, and determining what is the fair share for the various scenarios.

Of particular concern are the illiquid assets which may not have an alternative source to pay any tax liability that might be tied to a asset value, rather than an actual income stream.

As others may note, it is difficult to pay taxes on a piece of property that has ballooned in value, especially if on a fixed income.

So, I'm all for welcoming the new millionaires; let's hope they actually have some income that will generate new tax revenues for Oregon.

We should put out the welcome mat. Oregon is a great place to live.

11:18 a.m.

Jun 3, '11

I find it kind of funny that people are assuming that a projection 9 years in the future, in a report purporting to make predictions all over the world (of which Oregon is a tiny tiny little part), has any chance of being right.

I'd be much more interested in finding out how many millionaires (and, more importantly from a capital-to-invest perspective, deca-millionaires) Oregon had in 2010 compared to 2000. I know for a fact that Oregon's current tax structure has caused many of the ones that were here in 2000 to leave. Have we had sufficient in-migration to make up for it? Those would be real, useful numbers; not some projection that has absolutley no chance of actually turning out to be correct.

10:36 a.m.

Jun 6, '11

Bob -- you repeatedly say something along the lines of what you post here "I know for a fact that Oregon's current tax structure has caused many of the ones that were here in 2000 to leave" -- but you've never shared the facts.

Please provide us with the names of the "many" and provide the basis for your "fact" as to the cause for each person's departure.

And you haven't moved, right?

8:09 a.m.

Jun 7, '11

I'm not going to "name names". However, just because you are not convinced of the existence of a fact does not mean that the fact does not exist.

I haven't moved out of the state. If I do, I won't be issuing a press release about it.

12:50 p.m.

Jun 7, '11

There are known knowns and unknown knowns, and there are knowns because someone says so, and that's the end of it, eh?