SB 817: Will Wall Street Score an End-of-Session Win?

Chuck Sheketoff

Will the Oregon legislature really make lining the pockets of Wall Street and wealthy investors a priority before adjournment sine die?

With SB 817 headed to the floor of both chambers in these final hours, it looks like Wall Street and other wealthy corporate investors may be getting a $78 million parting gift.

The legislature is once again considering establishing a state version of the federal New Markets Tax Credit (NMTC). Under SB 817, the Oregon tax credit could cost taxpayers $78 million over five years.

In theory, the federal NMTC helps fund economic development in low-income communities by providing project investors a tax credit covering 39 percent of the “qualified” investment.

Sadly, wealthy investors — including Prudential, Goldman Sachs and U.S. Bancorp — have been gaming the tax credit (video).

According to a Bloomberg news story, the NMTC has subsidized “more than 300 upscale projects, including hotels, condominiums, office buildings and a car museum, on streets far from poverty.” Examples of others who benefit from the NMTC are those who invest through Missouri-based Advantage Capital Partners, who have led the charge lobbying the Oregon legislature for the subsidy.

Oregon is no stranger to such shenanigans. In 2008, investors in The Nines, a “luxury collection hotel” in downtown Portland got a luxurious tax credit thanks to the federal NMTC. Prudential Financial Inc. reportedly cashed in a $27.3 million new markets tax credit from its investment in The Nines.

With the Campbell family’s Victory Group directing the lobbying effort, wealthy investors are now lobbying to get Oregon to offer its own NMTC. They propose that Oregon match dollar-for-dollar the federal tax credit. If the legislature passes SB 817, investors would receive a combined federal and state tax credit of 78 cents for every dollar invested.

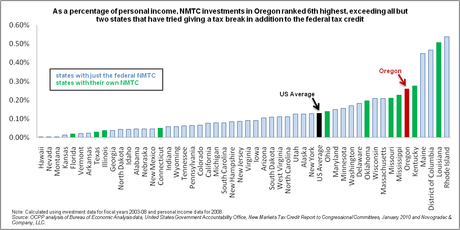

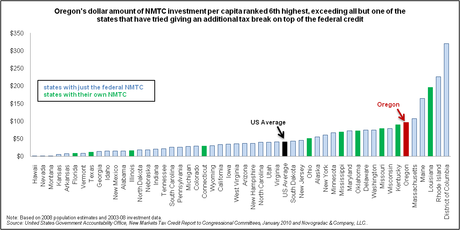

Those pushing for an Oregon NMTC claim that it would attract investment to the state, but Oregon is already among the highest recipients of NMTC investments.

Even without a state NMTC:

• Oregon received almost 3 percent of all NMTC projects conducted in fiscal years 2003 to 2008, even though Oregon accounts for only about 1 percent of the national economy.

• Oregon took in about 3 percent of all NMTC loans and investments during fiscal years 2003 to 2008, even though Oregon accounts for only about 1 percent of the national economy.

• Oregon ranked 6th highest in the nation among all states and the District of Columbia in terms of the amount of NMTC investments as a percentage of personal income during fiscal years 2003 to 2008.

• Oregon ranked 6th highest in the nation among all states and the District of Columbia in terms of the dollar amount of NMTC investment per capita.

There’s no need for Oregon to enact a state NMTC to attract NMTC investments. The money is already coming in.

And as the funding of The Nines shows, some of the state NMTC would fill the pockets of Wall Street with precious state revenue, on top of the federal tax money they are already taking.

Adding insult to injury, despite lots of talk about jobs in Salem, under SB 817 the tax dollars are doled out to Wall Street without any specific requirements that jobs be produced.

SB 817 is about the legislature's priorities and Oregon’s priorities. Is it really a priority to line the pockets of Wall Street and wealthy investors?

If you think SB 817 represents the wrong priority, contact your legislator right now. The votes in the House and Senate are imminent in the rush to adjournment.

Chuck Sheketoff is the executive director of the Oregon Center for Public Policy. You can sign up to receive email notification of OCPP materials at www.ocpp.org.

Chuck Sheketoff is the executive director of the Oregon Center for Public Policy. You can sign up to receive email notification of OCPP materials at www.ocpp.org.

|

More Recent Posts | |

Albert Kaufman |

|

Guest Column |

|

Kari Chisholm |

|

Kari Chisholm |

Final pre-census estimate: Oregon's getting a sixth congressional seat |

Albert Kaufman |

Polluted by Money - How corporate cash corrupted one of the greenest states in America |

Guest Column |

|

Albert Kaufman |

Our Democrat Representatives in Action - What's on your wish list? |

Kari Chisholm |

|

Guest Column |

|

Kari Chisholm |

|

connect with blueoregon

10:52 a.m.

Jun 20, '11

Chuck, Happy to discuss this with you, but I first wanted to provide a quick correction. All the data you provide and the projects you mention (like the Nines) would be specifically excluded in SB 817 as amended. SB 817 is limited to access to capital for small businesses in low income areas, specifically because of the problems you cite. I'd urge you to read through the bill.

Best, Jules Bailey

11:18 a.m.

Jun 30, '11

Jules, this is trickle down economics. As a Democrat in a progressive district do you support trickle down economics? It sure seems like it

12:57 p.m.

Jun 20, '11

Jules,

I am familiar with the bill and the -1 amendment. Perhaps you can point to particular language showing otherwise, but I see nothing in the bill or the amendment that limits the investments to small businesses.

Yes, there’s a limit of $4 million per investment available for the credit (up from $3 million in the original bill), but that could be $4 million of a larger investment. In other words, investors may not get the full 39 percent of their total investment back from the state if their full investment is greater than the $4 million eligible for tax credits; they will still get the 39 percent back from the federal tax credit.

Does the $4 million limit mean this only goes to small businesses? A very large business – say a national restaurant chain – could have a building built for less than the $4 million and be the beneficiary of the investment.

And yes, the bill as amended does prohibit NMTCs for a business that “derives or expects to derive 15 percent or more of its annual revenue from the rental or sale of real estate,” but that doesn’t solve the problems either. It kicks out some development companies, but many of the large corporations who are a part of the "American Capital family" would still qualify. Do insurance companies and Wall Street banks derive 15 percent or more of their annual revenue from real estate rental or sale? I doubt it.

And contrary to what is implied by your comment, the bill does not change or improve the definition of “low income areas” that has been and will continue to be used.

Further proof that the bill is overly generous to the beneficiaries of the tax credits is that the investors can carry forward their tax credits indefinitely. I may be wrong, but all other tax credit programs in Oregon that allow taxpayers to carry forward unused credits limit the number of years for the carry forward, typically to 3 to 7 years. Why is the legislature allowing these investors to carry forward the credits indefinitely? Is that a good precedent to set?

2:22 p.m.

Jun 20, '11

Jules, my rep in district 42, has just sent me an email that makes the very claims that Chuck refutes here, and some others as well. I promised Jules's office that I'd review the bill as well as some related links that he sent to me and get back to him.

But taxpayers don't have the luxury of time for study--I believe the bill will be voted on in the senate today or tomorrow.

Therefore I just now suggested to Jules's office that given the disagreements about the contents of this complex bill, Jules should consider voting against this bill and FOR the state bank bill, which would address the same need for loans in low-income areas, but without the huge expenses of the New Market scheme in SB 817.

2:50 p.m.

Jun 20, '11

The definition of low income community is not changed by Oregon’s bill, it’s defined by federal law. 12W (the Portland building with the windmills atop providing space for a very successful architectural firms and fabulously expensive condos) recently got federal NMTC and the Schnitzer re-model is lined up to get federal NMTC. So these are low income communities. Businesses of any size next to the low income community of students at PSU or some low income housing units would clearly still be eligible, without providing any benefits to the low income.

Jules, please show us where in the bill or amendment are any provisions that limit our program to small businesses? As I read the amendment and the bill, the limit is only against businesses that make “15% or more of their gross revenue from the rental or sale of real estate.” It would seem that Bank of America, Mentor Graphics, Providence, WalMart and Farmers Insurance would all meet that requirement.

Another not mentioned issue: the bill does not allow OBDD to choose the best projects. The bill requires that projects be approved on a first come first serve basis.

5:02 p.m.

Jun 20, '11

I'm seriously curious about your reference to Mentor Graphics. Can you pop me a link that would explain why they belong in that roster of out-of-state mega-corporations? I'm not being sarcastic... I just might have to put in a sell order to my broker.

7:55 a.m.

Jun 21, '11

No reason at all for calling them out in particular, or any of the others. As far as I know Mentor is a great company. But like the others on the list, there is no reason the taxpayers gain somthing by paying for up to 78% of a new building for them.

5:06 p.m.

Jun 20, '11

Thanks, Chuck. Like I needed another Sheketoff posting that has me chasing my antacid pills with scotch and wondering whether we have a hope in hell of winning even some of these battles against taking from the middle and giving to the rich.

9:18 p.m.

Jun 20, '11

Larry, so you're choosing a bottle-in-front-of-me instead of a frontal lobotomy? I am sure you are not alone in your frustration.

But here's some better medicine: funny, satirical folk music from the wickedly inventive Roy Zimmerman. Get a preview at http://www.tinyurl.com/Roy-Carl20110620 and go to www.ocpp.org/june22 to purchase.