One Chart Shows Obama Is Right About "Buffett Rule"

Chuck Sheketoff

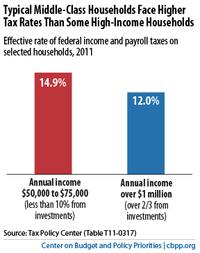

One chart by our colleagues at the Center on Budget and Policy Priorities (CBPP) that uses data from the Tax Policy Center (TPC), is all President Obama needs to show why he's right in proposing to raise federal taxes on the wealthiest Americans (the so-called “Buffett Rule” ).

As CBPP notes, the chart shows that a significant group of very wealthy people pay a smaller share of their incomes in federal income and payroll taxes than a large swath of the middle class. How can this chart be so? It is simple: the federal capital gains and dividends tax rates are low compared to the income tax on work paid by the middle class, and wealthy people pay payroll taxes at a much lower rate than middle-class Americans.

Read The Case for the Buffet Rule in One Chart (a short blog post) and study the chart and come back here to discuss.

Chuck Sheketoff is the executive director of the Oregon Center for Public Policy. You can sign up to receive email notification of OCPP materials at www.ocpp.org.

Chuck Sheketoff is the executive director of the Oregon Center for Public Policy. You can sign up to receive email notification of OCPP materials at www.ocpp.org.

|

More Recent Posts | |

Albert Kaufman |

|

Guest Column |

|

Kari Chisholm |

|

Kari Chisholm |

Final pre-census estimate: Oregon's getting a sixth congressional seat |

Albert Kaufman |

Polluted by Money - How corporate cash corrupted one of the greenest states in America |

Guest Column |

|

Albert Kaufman |

Our Democrat Representatives in Action - What's on your wish list? |

Kari Chisholm |

|

Guest Column |

|

Kari Chisholm |

|

connect with blueoregon

5:00 p.m.

Sep 21, '11

Chuck, the AP article on this issue had the following; "This year, households making more than $1 million will pay an average of 29.1 percent of their income in federal taxes, including income taxes, payroll taxes and other taxes, according to the Tax Policy Center, a Washington think tank. Households making between $50,000 and $75,000 will pay an average of 15 percent of their income in federal taxes."

I realize that they tossed in payroll taxes and other federal taxes, but I don't know how you can go from 12% to 29% based on that. Moreover, the rate quoted for the $50-75k is identical. Somehow your source and the AP source are talking apples and oranges. Do you understand the discrepancy?

11:56 a.m.

Sep 22, '11

John,

It is a bit of “apples and oranges.” The main "apples and oranges" aspect is that the AP story is talking about what millionaires on average pay in federal taxes, while the CBPP chart and blog post highlights that a significant subset of millionaires – those with substantial income from capital gains and qualified dividends – pay a lower effective combined income and payroll tax rate as typical middle class Americans.

The Tax Policy Center table that is linked to and discussed in the CBPP blog post (here) splits out millionaires by percent of income from capital gains and qualified dividends. It is the group with 33 percent or more of their income from capital gains and qualified dividends -- what CBPP and I refer to as "a significant group of very wealthy people" -- that has a lower effective income and payroll tax rates than typical middle class people.

Another apples and oranges aspect is that the AP story looks at all federal taxes which means it includes corporate taxes.

5:17 p.m.

Sep 22, '11

In general, anytime you're talking about millionaires (or further, people with million-dollar annual incomes) it's probably a bad idea to be talking about averages.

Bill Gates walks into a homeless shelter. On average, everyone there is a millionaire.

3:49 p.m.

Sep 22, '11

Another thing they keep trying to bury is the number of people making over $1 million who paid no income taxes at all. The number for 2009 was almost 1,500 people and I heard it was significantly higher for the 2010 taxes.

Now 1,500 people may not seem like a lot when you think about how many taxpayers there are in this country. But if you assume that those people only made a million, that would be equal to more than 30,000 average American households (households, not individuals).

People like to bash those at the bottom income levels for not paying any taxes. What about those making over a million? They're much more able to pay their taxes than a mother raising two kids and making $17,000 a year.

6:34 p.m.

Sep 22, '11

Equating capital gains taxation with personal income tax is a classic example of comparing an apple to an orange. That being said, what would be your preferred tax rate on capital gains and how would the economy benefit?

11:33 p.m.

Sep 22, '11

As former Vermont Governor Jim Douglas (R) said in 2008 in calling for the elimination of Vermont’s preferential treatment of income from capital gains, our current tax structure taxes earned income – that is, your hourly wage or salary – at a higher rate than it taxes unearned income. What this means is that a working man or woman pays more tax than someone who does not work and simply lives off investment or trust fund capital gains income in the same amount. Douglass said it is "an unfair penalty for doing an honest day’s work. This is grossly unfair. We must close this loophole and eliminate this working tax penalty."

5:39 a.m.

Sep 23, '11

I tried to "study" the chart but all it gves is a result, not what factors produced that result. Since capital gains and dividends are taxed at 15%, I'm not exactly sure how the rate for people making over $1 million a year gets down to 12%.

Is this by factoring in tax free municipal bonds? Charitable deductions? If so, is that what you want to get rid of, either directly or by going back and taxing the "rich" for buy municipal bonds or making "excessive" charitable contributions? If so, who's really going to suffer, the "rich" or charitable organizations and the cities and counties who issue tax-free bonds?

5:43 p.m.

Sep 23, '11

No need to put words in anyone's mouths, Jack. Let's just go with the Republican former Governor of Vermont: tax unearned income at the same rate as earned income.

Something else to keep in mind: this is personal income. If business owners re-invest their company profits in their own businesses (by, I don't know, say, hiring people), those profits are not taxed (since they become expenses) AND whatever increase there is in the worth of the business as a result of that investment is not taxed at all unless an owner sells shares or takes a dividend. Our backwards system now actually encourages owners to literally take the money and run, which does terrible things to an economy.

5:50 p.m.

Sep 23, '11

You know you're arguing for a flat tax don't you?

6:47 a.m.

Sep 24, '11

That is not an argument for a flat tax. A flat tax would not be nice.

8:29 a.m.

Sep 24, '11

So where does everyone here have their nest egg, 401K, or IRA invested? Would you rather the income from non tax-protected nest egg investments be taxed at ordinary income rates, or the current 15% max for dividends or long term gains? For everyone, or only those above a certain income level? And as Jack notes above, what about investments in public/government bonds? Should those be taxed, too?

Sure, most 401K and normal IRAs will have proceeds taxed at ordinary income rates when withdrawn. But what about all those Roth IRAs which will have no tax at all?

Are you advocating a new AMT to make sure all income is taxed? Will the fix grow from the targets few hundred non-taxpaying rich of the 60's to the millions affected today?

Shall we start taxing non-property assets, too, to generate more tax revenue? What about those non-liquid assets?

Just what is a fair share, and who should pay it? The line must be drawn somewhere, or not at all. What is the end-all solution? Surely there must be a report somewhere that summarizes an answer.