The Rich Do Very Well When the Middle Class is Helped by Tax Cuts

Chuck Sheketoff

The Center on Budget and Policy Priorities recently published a short paper High-Income People Would Benefit Significantly From Extension of “Middle-Class” Tax Cuts (or 8-page PDF here).

The paper notes

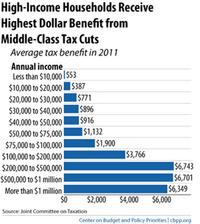

A fact generally overlooked in the debate over whether Congress should extend the high-income Bush tax cuts — i.e. those targeted exclusively at couples making over $250,000 and single individuals making over $200,000 — is that these households will still receive substantial tax cuts if Congress extends the so-called “middle-class” Bush tax cuts while letting the high-income tax cuts expire as scheduled.

This is because the 2001 tax law’s reductions in the lower tax brackets benefit not only people whose incomes fall within the lower brackets but also those whose incomes exceed those brackets. In fact, high-income people actually receive much larger benefits in dollar terms from the so-called “middle-class tax cuts” than middle-class people do.

It's yet another reason why Congress should allow the Bush-era tax cuts that benefit only the wealthiest Americans to expire as scheduled.

UPDATE: See Paul Krugman's column Now That's Rich.

Discuss.

Chuck Sheketoff is the executive director of the Oregon Center for Public Policy. You can sign up to receive email notification of OCPP materials at www.ocpp.org.

Chuck Sheketoff is the executive director of the Oregon Center for Public Policy. You can sign up to receive email notification of OCPP materials at www.ocpp.org.

|

More Recent Posts | |

Albert Kaufman |

|

Guest Column |

|

Kari Chisholm |

|

Kari Chisholm |

Final pre-census estimate: Oregon's getting a sixth congressional seat |

Albert Kaufman |

Polluted by Money - How corporate cash corrupted one of the greenest states in America |

Guest Column |

|

Albert Kaufman |

Our Democrat Representatives in Action - What's on your wish list? |

Kari Chisholm |

|

Guest Column |

|

Kari Chisholm |

|

connect with blueoregon

1:18 p.m.

Aug 22, '10

This issue is so cut and dry simple, I don't know why there is any debate about it. Let them expire for the wealthy. Keep them for the people who really need them, the middle class.

7:39 a.m.

Aug 23, '10

I personally think all the cuts should be allowed to expire. The bottom line is that government needs the revenue, and needs it to be stable. Everyone uses the services. I don't think we can afford Obama's plan.

1:01 p.m.

Aug 23, '10

Top 1% $410,096 40.42 Top 5% $160,041 60.63 Top 10% $113,018 71.22 Top 25% $66,532 86.59 Top 50% $32,879 97.11 Bottom 50% <$32,879 2.89

Here are the fed income tax numbers from 2007. The top 1% paid 40% of the taxes. Just what do you want them to pay, 60%? The top 50% of wage earners pay 97% of the fed income taxes. If you think there is revenue problem (not spending) you are basically living in a dream. The real question is how much money do you think can be sucked out of an economy before you harm it permanently? The above graph takes on a different meaning if you label it with percentages like taxes are levied. Tax benefits then become: 10k would be 0.53% of income 20k 1.92% 30k 2.57% 40k 2.24% 50k 1.83% 75k 1.5% 100k 1.9% 200k 1.88% 500k 1.34% 1Mil 0.67 % 1+mil 0.63 But that would be making a different point, right Chuck? I guess giving those ugly, greedy, rich folk a 1% break when they are paying 40% of the tab is whack. But then, we wouldn’t want anyone’s tax rebate related to the actual tax they pay would we?? As far as govt NEEDING revenue Theresa, please feel free to send them YOUR revenue. Feel free to be liberal, WITH YOUR OWN MONEY.

6:03 p.m.

Aug 23, '10

The middle American family earns around $50,000.

I find it amazing that the middle class now evidently extends up to $200,000-250,000. Since the only Bush tax cuts that seem likely to be allowed to expire are those for the "wealthy, defined as individuals with taxable income of over $200,000 and families with taxable income over $250,000." While those for the "middle class" will likely be extended.