A Tax Code Subsidy Gets Ways and Means Review: A Reality-Based Fiction

Chuck Sheketoff

Chair Howie Prioritize: The Ways and Means Subcommittee on Housing Opportunity and Jobs will come to order. Today we’re going to hear from Rich Houser, the director of Oregon’s housing and economic development agency. Mr. Howzer is going to talk about Oregon’s program that subsidizes home loans. Rich, glad to have you here today.

Rich Howzer: Thank you, Chair Prioritize and members of the Committee. I am Rich Howzer, director of Oregon’s housing agency and I am here today on behalf of the Governor telling you about the cost of our program that subsidizes home mortgages. It’s a program that’s been on the books for decades and plays an important role in helping Oregonians purchase a home. In this economy, with the terrible housing market that we’ve had for the past two years, I hope you will once again see why this program is important for Oregon.

Chair Howie Prioritize: Thank you Rich. Let’s get down to the basic facts and numbers about the program. We all know about it – heck, if there’s a state program that’s a third-rail of Oregon politics, this is it. I know it is awkward asking questions about a program that’s as popular as apple pie and motherhood, but it’s my job to ask. First, how much did this program cost in the 2005-07 biennium before the housing crash really hit?

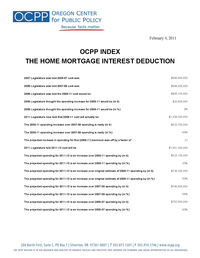

Rich Howzer: I first want to say I’m going to be going over a lot of numbers today. All of them come from the index (PDF) we’ve distributed to the committee. You may want to refer to it as I go along. Now to your question, Chair Prioritize. The program cost about $849 million in 2005-07 before the housing crisis hit. And in 2007-09 its cost was $885 million.

Chair Howie Prioritize: My recollection from last session, in 2009, is that you told us that in 2009-11 the spending was only going to go up 2 percent, or $21 million, to $905 million. Is that right?

Rich Howzer: That’s correct. That’s what we told you two years ago. But I must tell you that we now think the program is costing us a little over $1.3 billion in this 2009-11 biennium, 48 percent more than it cost in 2007-09.

Chair Howie Prioritize: Come again? You’re telling me that we thought spending would increase by about $21 million and it actually increased by about $424 million? That’s almost as much as the entire budget for the Portland Public Schools for one year. We don’t let spending on education, health care, early childhood education and development, public safety and corrections run over costs like that.

How can you be overspending on the subsidy like that?

Rich Howzer: We’re not overspending. You gave us a blank check for this program.

Chair Howie Prioritize: What do you mean, “a blank check?”

Rich Howzer: When you created this program decades ago, you set no cap on how much money we can spend. You set no “sunset” or expiration date that would automatically force a re-evaluation of the program. Unless you vote to kill or modify the program, it lives on indefinitely, without limit on how much money it can gobble up. Our projection was off because as I am sure you can appreciate, it's hard to predict what’s going to happen in this vital part of the economy two years into the future.

Chair Howie Prioritize: So, how much are you expecting this program to cost us in the upcoming 2011-13 biennium?

Rich Howzer: About $1.6 billion. That’s 25 percent, or about $323 million, more than we’re spending now and 84 percent more than in the last biennium.

Chair Howie Prioritize: At a time when the state is facing a $3.5 billion revenue shortfall and every legislator here has to find deep cuts in state programs, you are asking for a 25 percent, $323 million, increase, and that's on top of spending more than you said you would this budget period.

Rich Howzer: With all due respect, we’re not asking for permission. We’re just letting you know. As I noted earlier, because of the way the program is structured, we get the money automatically without any review of the program. And it’s an open-ended appropriation. Our spending could go up by more than the $323 million we anticipate for the next two years. The reality is the train has no breaks. We’re just bringing the numbers to your attention today since we know your wallet is a bit tight right now, with the recession and all.

Chair Howie Prioritize: Well, thank you. At $1.63 billion for the upcoming budget period, this is a large spending program. Can I rest assured that almost every taxpayer directly benefits from it?

Rich Howzer: Well, no, you can’t sir. The last time we looked at the numbers we found that nearly two out of three households – 64 percent – receive no benefit from the program.

Chair Howie Prioritize: But at least it helps those who need the most help, low- and moderate-income households, right?

Rich Howzer: Sorry, but not really. In fact, we’ll subsidize up to $1 million in mortgage indebtedness. People who can afford a $900,000 mortgage aren’t exactly low- or moderate-income households, frankly.

The program is helping few low- and moderate-income households. Only 13 percent of households with incomes below $40,000 used the program. In other words, a small fraction of taxpayers having low- to middle-incomes get to use this subsidy.

Chair Howie Prioritize: I know that many states have a similar program but there are a handful of states that don’t. Those states that don’t have this subsidy program have lower homeownership rates, right?

Rich Howzer: You’d think so, Senator, but that’s not necessarily the case. The last time we looked at the nine states that do not offer a similar program, seven of them had home ownership rates higher than the national average, while Oregon’s homeownership rate was below the national average. This program is not well-suited to improving Oregon’s homeownership rate. Anyone who has studied it would have to admit that.

Chair Howie Prioritize: And if we do nothing, this program continues unabated? It will continue subsidizing the wealthiest of homeowners while helping few low- and moderate-income Oregonians or first-time home buyers?

Rich Howzer: That’s correct.

Chair Howie Prioritize: But if we think this program represents misplaced spending priorities we can easily change it, right?

Rich Howzer: Well, not exactly. I think you might very well run into a political buzz saw, even though all you'd be doing is improving a spending program.

Chair Howie Prioritize: Thank you Rich for this sobering testimony.

Committee, besides encouraging you to study the index (PDF) that Rich shared with us, I want to give you a heads-up for what else is on our agenda in the coming days.

We are going to consider expanding the subsidy we give film and video companies who want to film movies, ads and TV shows that take place in Oregon, and then we’re going to talk about a new subsidy program that only your most wealthy campaign contributors will likely benefit from as we create a small work penalty for the majority of your constituents.

Until then, this committee is adjourned.

Discuss.

Chuck Sheketoff is the executive director of the Oregon Center for Public Policy. You can sign up to receive email notification of OCPP materials at www.ocpp.org.

Chuck Sheketoff is the executive director of the Oregon Center for Public Policy. You can sign up to receive email notification of OCPP materials at www.ocpp.org.

|

More Recent Posts | |

Albert Kaufman |

|

Guest Column |

|

Kari Chisholm |

|

Kari Chisholm |

Final pre-census estimate: Oregon's getting a sixth congressional seat |

Albert Kaufman |

Polluted by Money - How corporate cash corrupted one of the greenest states in America |

Guest Column |

|

Albert Kaufman |

Our Democrat Representatives in Action - What's on your wish list? |

Kari Chisholm |

|

Guest Column |

|

Kari Chisholm |

|

connect with blueoregon

8:16 p.m.

Feb 4, '11

It would be political suicide to take this one on. But the thing is, mortgage interest deductions don't really do much, beyond helping to inflate the cost of housing by pushing the threshold of affordability upward.

Canada doesn't let homeowners deduct the interest on their mortgage ... and their rate of home ownership is the same as in the U.S. Really, Congress should dump the deduction nationally. I doubt they will, but they should.

What the legislature COULD do is to simply rewrite the entire income tax code from scratch and simplify it: 5%, 7%, 9% and 11% rates with much larger standard deductions and exemptions and much wider brackets -- and NO tax credits or deductions at all. Fair trade-off; you pay less at the lower end of the scale and get a bigger standard deduction, in exchange for losing every itemized deduction there is. No, you don't get to deduct mortgage interest, BUT you're keeping a lot more of your money at the bottom even before the 5% bracket kicks in, so you can still pay for it.

I think it would be a little easier to cancel the really popular deductions as long as they're ALL tossed out at once. But it needs to be ALL the tax expenditures, because if the legislature makes an exception for even ONE, then every special interest will be pushing for "me too." (They'll all be seeking special treatment anyway, but it'll be easier to justify the loss of an itemized deduction to voters at large when "all the deductions went.")

Two years later, in the NEXT session, the legislature can start putting in various deductions and credits one at a time, with a sunset date on each one. They should, however, require a ten-year project of how each tax expenditure will affect the budget.

8:31 a.m.

Feb 5, '11

Instead of scrapping everything you could add a means test, or a simple limit on how much interest could be deducted. I think that would be politically more sell-able.

9:32 a.m.

Feb 5, '11

For ideas about how to improve the home mortgage subsidy, see pages 51 to 53 of Rolling Up Our Sleeves(PDF). There are a number of things that can be done to better target the subsidy and have more accurate cost estimates. That a program is costing $403 million more than legislators thought it would cost is obscene and ought to put the issue on the table for reform.

11:25 a.m.

Feb 5, '11

Reforming tax expenditures reminds me of the rainy day fund. It's hard for legislators to take away specific benefits for specific people in order to give unspecified benefits to unspecified people.

2:20 p.m.

Feb 5, '11

I’m ok with phasing out the mortgage interest deduction, but, that said, I do not understand the financial dynamics here. For example, using an Oregon tax rate of 10%, to get an additional, unexpected $423 million in lost revenue due to the mortgage interest deduction, mortgage interest in Oregon would have needed to increase by (a factor of 10) $4.23 billion over what was forecast. I find that hard to believe in this economy. What am I missing?

5:16 p.m.

Feb 5, '11

In the 2009-11 Tax Expenditure Report the Department of Revenue wrote that "In 2006, about 625,000 Oregon taxpayers lowered their taxes by about $492.5 million using this itemized deduction for home mortgage interest. The average tax savings was about $787." The new 2011-13 report says "In 2008, about 617,000 Oregon taxpayers lowered their taxes by a total of about $554.8 million using this itemized deduction. The average tax savings was about $899."

Remember, the projection in the table and this post is for two years.

How did they get off by so much? Great question. Direct appropriations don't allow for such errors.

2:18 p.m.

Feb 6, '11

Chuck, Thanks for this enlightening scenario. The problem is that it could be repeated for many other outrageous tax-code subsidies such as the notorious Business Energy Tax Credit (BETC), an example of greenwashing at its finest.

I don't think it helps to divert the discussion to a utopian overhaul of the entire tax code. What we need is more exposure of the issue in the expectation that if voters come to understand these huge hidden giveaways, they will stop them.

2:27 p.m.

Feb 6, '11

Great post, Chuck.

I'm waiting with bated breath for The Oregonian's expose of this tax break gone wild!

It would be a fitting follow-up project to their work on the business energy tax credit.

As another commenter noted, the incidence/final beneficiary of this tax break may not be the home buyer, but rather the homebuilders (and to a lesser extent, realtors and banks).

So who's getting the $1,630,000,000? Not the folks who need it most.