Voters' Schizophrenic Relationship to Budget Balancing

Jeff Alworth

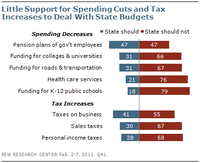

As the legislature gets ever deeper into wrestling with massive shortfalls, it's worth noting how difficult their task is going to be from a PR perspective. Americans are absolutely terrible about prioritizing things, as a new Pew poll illustrates. We'll get to some of the national findings later, but let's have a look at findings on voters' views about state budgets; it's almost comical how irony-averse their responses were.

To set the stage, it's worth mentioning that most states are in terrible shape, not just Oregon. And most states are legally bound to balance the budget--no deficits allowed. In order to do this, of course, they must either raise taxes or cut spending. Guess which they're willing to do?

Do you support decreasing support for these services...?

Funding for K-12 schools: No, 79-18%

Health care services: No, 76-21%

Funding for universities: No, 66-31%

Funding for roads/transportation: No, 67-31%

State employee pensions: Maybe, 47-47%Do you support raising these taxes...?

Personal Income: No, 55-31%

Sales tax: No, 67-30%

Businesses: No, 68-28%

With the exception of dinging employees on their pensions, voters aren't interested in cutting any services or raising any taxes. This will make the prospect for legislators especially dicey: no matter what they do to balance the budget, it's going to be unpopular. (If there is a possible silver lining for legislators, it's this: when Pew asked respondents how severe they thought their budget problems were, those on the West Coast were enormously more concerned: 62% calling them "very serious." The next closest region was the Middle Atlantic, at 44%.)

Below the jump, I'll mention a few of the national numbers, including the surprising finding about Americans' relationship to the deficit.

Despite the rhetoric on both sides about the need to reduce the deficit, Americans aren't that worried about it. Given four choices, a large plurality of respondents thought jobs were the most serious problem--not surprising. But the second most worrying issue to Americans is rising prices (inexplicably, given how little a problem inflation is). The deficit rates a tepid third-place showing. More amazingly, given a choice of among 17 service areas to cut back on, only on two did more Americans think we should cut back than increase spending (unemployment spending and international aid). If you wonder why Congress is keen to keep spending and never cut back, there's your answer.

In general, the mood of the country is improving. Americans are less morose than they've been in years. Their views about the economy is still bad, but it's heading in the right direction. They are not as negative about the parties or leaders--and Obama remains right-side up on his favorable/unfavs. Weirdly, on this question, "Could the president be doing more to help the economy," Obama's numbers, while bad (39%-56%) are actually better than Bush's at a similar point in his presidency (33%-61%).

You can read the whole report here.

|

More Recent Posts | |

Albert Kaufman |

|

Guest Column |

|

Kari Chisholm |

|

Kari Chisholm |

Final pre-census estimate: Oregon's getting a sixth congressional seat |

Albert Kaufman |

Polluted by Money - How corporate cash corrupted one of the greenest states in America |

Guest Column |

|

Albert Kaufman |

Our Democrat Representatives in Action - What's on your wish list? |

Kari Chisholm |

|

Guest Column |

|

Kari Chisholm |

|

connect with blueoregon

4:52 p.m.

Feb 11, '11

Why is anyone surprised?! There is plenty of research into "predictable irrationality," and the entire sciences of behavioral psychology and neuroeconomics to explain exactly why this happens. Rather than smuggly pointing it out, it would be better to head it off at the pass, so-to-speak. Since we absolutely KNOW this is going to happen, prepare for it at the time we pass new spending. We are only fooling ourselves if we think it's going to end differently next time.

5:29 p.m.

Feb 11, '11

Martin, if you know how to "head it off at the pass," by all means, do tell.

Otherwise, all we can do is note the phenomenon. (And I wasn't shooting for smug, btw.)

5:51 p.m.

Feb 11, '11

As a matter of fact - I do.

When writing the legislation, have a "Step Down" clause to elegantly reduce funding. Every bill has multiple levels of cost associated with it, and some priority assigned to those costs. Let the bill specify something like, "if funding is decreased by 10% then such-and-such is reduced; and for a 20% reduction, something else happens." AND "as funding becomes available, re-implement per similar levels."

11:37 p.m.

Feb 11, '11

That's not actually very elegant. Most funding comes out of the general fund and isn't associated with specific bills. You encumber spending without offering flexibility.

4:53 p.m.

Feb 11, '11

So at a national level, the least objectionable approaches to resolving the budget mess are, in order:

I find it encouraging that people are just a bit more willing to pay higher income taxes and sales taxes than to cut roads, health care or schools.

But now I'm curious what Oregonians think about these issues.

4:54 p.m.

Feb 11, '11

Huh. I thought that was formatted as a list.

12:31 a.m.

Feb 14, '11

Fixed. I suggest bullets.

5:38 p.m.

Feb 11, '11

Both of which, if combined and rounded up, total less than 2.4% of Federal spending (unemployment benefits and food stamps combined is barely 1.4% and foreign aide is less than 1%).

I did the exercise last year of fixing the Federal budget, and my solution went into surplus by 2015, made Social Security permanently solvent, without cutting benefits or hitting the social safety net.

But I'm just an unelected progressive schlub, so it won't count of course.

6:13 p.m.

Feb 11, '11

Looks like our City Council down here in Eugene will be voting next week to send a progressive income tax to the May ballot starting at the 50K income level. It's specifically for our school district and will expire in six years. The groups that have put this together have done polling and seem confident that it will pass. In other words, I think a lot of people are ready to raise income taxes on certain people for public education. Worth noting that our Governor has lent a hand to the right-wing anti tax crowd (who is preparing their anti-tax campaign as we speak) by taking an anti-local tax position. Even if this passes we will be firing teachers, cutting school days, and dinging pay and benefits in already crowded classrooms and a short school year. It's estimated to raise from 10-20 million annually. We're facing a 30 million shortfall which is tremendous for the size of our district. Extremely disappointed in our Governor to say the least.

6:21 p.m.

Feb 11, '11

Washington had one of these things fail in the last election. (By a lot.) I just don't think raising taxes is going to fly, and the effort depletes our optimism reserves while strengthening our opposition's commitment.

8:15 p.m.

Feb 11, '11

Washington is of course a different place than Eugene. I trust the polling which was done locally. I'm willing to risk loss of some optimism to avoid draconian cuts. If it fails I think the cuts will ultimately build more support around some sort of tax.

9:37 p.m.

Feb 11, '11

When we ask others to pay increased taxes so that our personal goals are reached, we are being arrogant and selfish. It is a blanket request for additional money without any recognition that the person paying it deserves representation as to what it is spent on. They have no input into the budget process, or where the money goes, or what the priorities are. They assume the extra money goes into PERS, teacher training, and whatever imaginations the opposition puts in their heads. To get tax increases, we will need to recognize that the people we are asking should have a say.

1:11 a.m.

Feb 15, '11

It is in everyone's interest to have an educated populace, particularly those of means.

7:47 p.m.

Feb 11, '11

I do not think one has to be right-wing to be concerned about the inefficiencies and irrelevancies of public education. The political culture surrounding public education in Oregon is very resistant to change. I do not live in Eugene, but the Eugene School District has repeatly stalled creation of a Mandarin immersion program and, as far as I know, does not have nor support creation of a high school study abroad program. I'm against the two Portland School levies for such reasons (here), and would probably be against the Eugene levy as well.

8:12 p.m.

Feb 11, '11

Nobody said you "had to be right-wing to be concerned about the inefficiencies and irrelevancies of public ed." I said that the governor taking the anti-tax position is helping the anti-tax campaign that will be owned and operated almost exclusively by right-wingers and I suppose some folks like yourself. I find your reasoning to crowd classrooms and shorten the school year even more utterly unpersuasive.

9:00 p.m.

Feb 11, '11

For once, Joshua, I agree with you.

8:59 p.m.

Feb 11, '11

David--

Mandarin Immersion is not the only game on the education block. Quite frankly, given the crisis overall in public education, making that your bottom line for support/non-support of education financing programs is a non-starter. Yes, it's a good idea...but I work in a district that recently created a Mandarin Immersion program, to the detriment of many other programs in the district which serve much more needy students. It's viewed as a cash cow at the moment more than trying to fulfill any particular mandate.

10:06 a.m.

Feb 13, '11

Two general points: (1)If the Mandarin immersion program in your district costs more than a normal classroom, it is not being well administered or initiated. (2) With teachers unions (OEA, PAT) not now supporting, and likely to oppose forever, paying to send high school students abroad, forever voting for increased educational budgets does not get us to the educational system we need for the 21st century. Change the system first, then I'll vote for more funding.